omaha nebraska sales tax rate 2021

Sales and Use Tax. There are no changes to local sales and use tax rates that are effective october 1 2021.

Sales Taxes In The United States Wikiwand

The Nebraska state sales and use tax rate is 55 055.

. Request a Business Tax Payment Plan. What is the sales tax rate in Omaha Nebraska. Find your Nebraska combined state.

The December 2020 total local sales tax rate was also 7000. What is the sales tax rate in Nemaha Nebraska. Businesses that make taxable purchases for resale manufacture or processing must pay a use tax instead of sales tax.

State Tax Rates. Local Sales and Use Tax Rates Effective April 1 2021 Dakota County and Gage County each impose a tax rate of 05. The local sales tax rate in Omaha Nebraska is 7 as of September 2022.

Beginning January 1 2021 the local sales tax rates for Gordon Greeley and Juniata will each increase from 1 to 15 which brings the total to 127 cities in Nebraska. The minimum combined 2022 sales tax rate for Omaha Nebraska is. This is the total of state county and city sales tax rates.

Groceries are exempt from the Nebraska sales tax. As we all know. See the County Sales and Use Tax Rates section at the.

See the County Sales and Use Tax Rates section at the. Current local sales and use tax rates and. The minimum combined 2022 sales tax rate for Nemaha Nebraska is.

That means that in a city that imposes. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

The current sales tax rate in Nebraska is 55. The base state sales tax rate in Nebraska is 55. The current total local sales tax rate in Omaha NE is 7000.

Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. 2020 rates included for use while preparing your income tax. This is the total of state county and city sales tax rates.

Counties and cities can charge an. 31 rows The latest sales tax rates for cities in Nebraska NE state. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the.

Changes in Local Sales and Use Tax Rates Effective January 1 2021. 2022 Nebraska Sales Tax Table. Make a Payment Only.

Local Sales and Use Tax Rates Effective January 1 2021 Dakota County and Gage County each impose a tax rate of 05. Sales Tax Rate Finder. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated.

Rates include state county and city taxes. The omaha sales tax is collected by the merchant on all qualifying sales made within omaha. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax.

Average Sales Tax With Local. The omaha sales tax rate is.

New Ag Census Shows Disparities In Property Taxes By State

Nebraska Sales Use Tax Guide Avalara

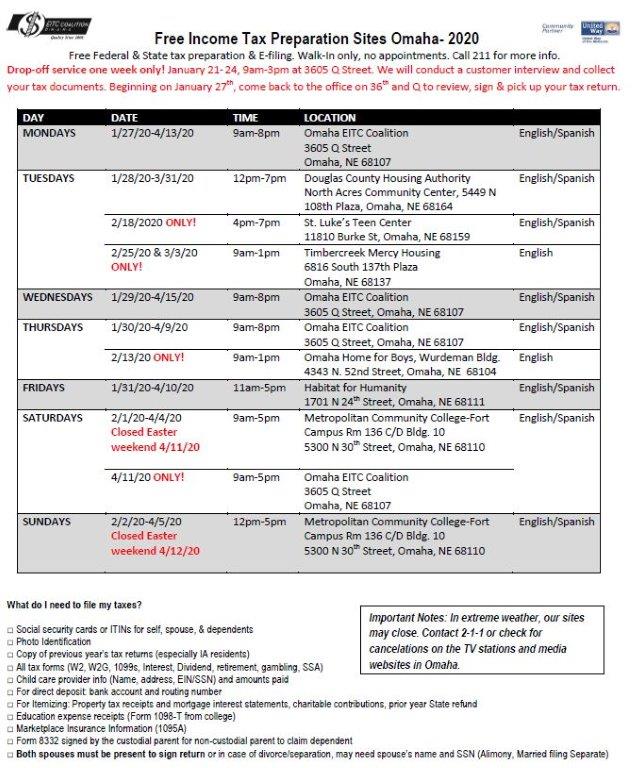

Free Tax Preparation Sites In Omaha Nebraska Department Of Revenue

How High Are Cell Phone Taxes In Your State Tax Foundation

Taxes And Spending In Nebraska

Compared To Rivals Nebraska Takes More From Taxpayers

Don T Die In Nebraska How The County Inheritance Tax Works

Get The Facts About Nebraska S High Tax Burden

Nebraska Sales Tax Small Business Guide Truic

The Most And Least Tax Friendly Major Cities In America

Nebraska Sales Tax Rates By City County 2022

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Taxes And Spending In Nebraska